Expiring 2012 Tax Rates – Considerations

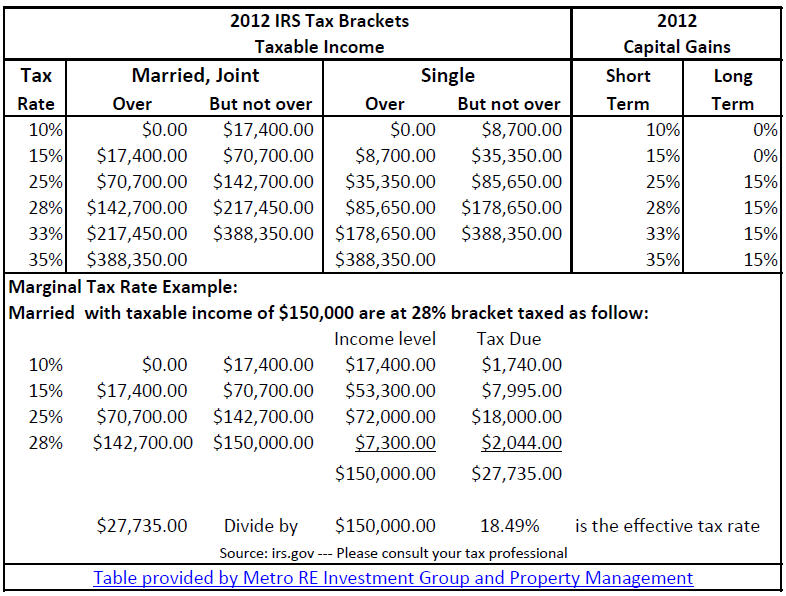

With the 2012 tax rates expiring, I thought to recap where the 2012 tax rates, brackets, and capital gains rates are along with an example of how the marginal tax rate is calculated. As the example shows, one in the 28% bracket does not pay 28% of the income for taxes. The tax is calculated in an stair-step manner on each income level.

A landlord (couple) may be considering selling their rental property to take advantage of the 0% (or low 15%) long-term capital gains rate. Long-term is considered for assets kept over 1 year.

The other tax consideration before selling is the Depreciation Recapture tax which is at 25%.

Here is an example:

| Assumptions: | ||

| Purchase Price | $125,000.00 | |

| Depreciation Amount | $45,000.00 | |

| Sales Price | $200,000.00 | |

The basis in the property is the purchase price less the depreciation amount.

| Purchase price | $125,000.00 | |

| Less Depreciation | $45,000.00 | |

| Basis= | $80,000.00 | |

The gain in the property would be the sales price less the basis.

| Sales price | $200,000.00 | |

| Less basis | $80,000.00 | |

| Gain= | $120,000.00 | |

How are the taxes calculated? The depreciation amount is taxed 25%.

The remaining amount is taxed at the Long-term capital gains rate. The investor in 10% or 15% brackets have no tax on the remaining gain.

| Depreciation | $45,000.00 | * | 25% | $11,250.00 | |

| Long Term Gains | $75,000.00 | * | 0% or 15% | ||

**This is not a tax advice. Please consult with your tax professionals.**