Past Real Estate Trends: What do they reflect about today’s Market?

When talking about the real estate market, common words associated with the market are: volatile, confusing, unpredictable, and fluctuating, to name a few. So, in a market that’s anything but consistent, what can past trends tell us about what to expect?

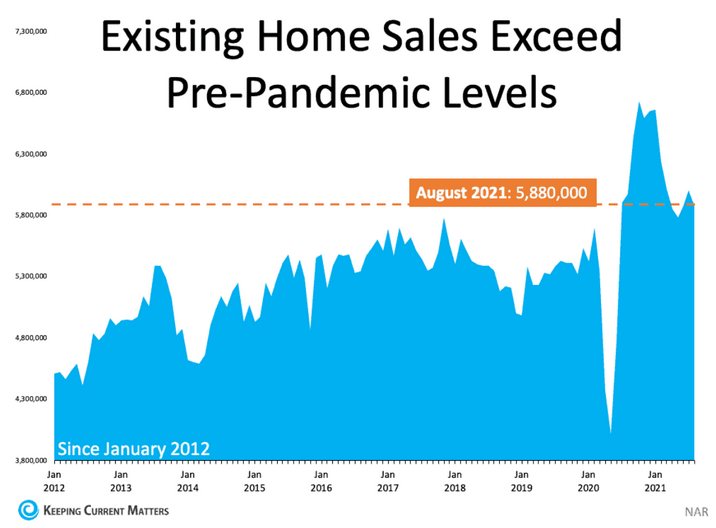

Sales are still above average

For starters, we know that investors still see value in the real estate market. In fact, we’re set to reach record purchase numbers in the 3rd quarter. According to a Seattle-based Real Estate company, investors “purchased a record $64 billion worth of homes.” The reason for this record home shopping spree? Redfin Chief Economist, Daryl Fairweather explains: “Even though home prices are high, they are waiting for rents to grow and there are no signs that prices will decline.”

While you may be seeing headlines here and there about home sales dropping, looking at the historical context is key to understanding if that’s actually true. When compared to home sales over the past decade, it’s easy to see home sales are well ahead of the years we had before the COVID-19 pandemic.

So, if you were thinking about listing your home and those headlines scared you off, think again! We can help you with the whole process and give you honest advice with the most current Intel in mind, simply give us a call.

Houses are selling fast

Once again, looking at past trends helps us to discern how well the market is faring today. When compared to previous years, data shows that homes are selling faster today than even in just the last year! According to the Realtors Confidence Index from NAR, properties stayed on the market for an average of 17 days, as compared to 22 days the year before. In fact, 87% of properties sold in August sold in less than a month! In 2010, the number of days a house spent on the market was far longer – 140 days! Clearly, history shows us that while the market may seem to be “cooling”, it is anything but.

Interest rates are ideal

Though one may look at the prevailing 3% interest rates we’re looking at now with some hesitation, we cannot overlook the fact that historically, these rates are favorable to say the least! Back in 1982, interest rates went as high as 17%, and only just two decades ago they were set at around 8%. When favorable credit like this is available, it’s essential to take advantage of it and purchase. If you’ve been considering a home purchase, but are hesitant, let these numbers help you see that right now, while it may seem like a seller’s market, in many ways, it’s a buyer’s one too.

So, what does it all mean?

Your best bet for success in this market is to embrace the benefits of relatively cheap credit while remaining within your means. That’s how you’ll build equity, secure homeownership, and come out on top. While real estate can seem mysterious to some, it’s what we do best. Whether you need assistance with an investment property, buying your first home, or with managing your most recent purchase, we can help. We’re a full service brokerage with a deep understanding of the real estate market and its many complexities, give us a call.